On October 15, South Korean materials company SKC Co., Ltd. (KRX: 011790) announced that it will merge with its semiconductor materials investment subsidiary SK Enpulse as part of a broader business restructuring aimed at strengthening its high-value semiconductor and advanced materials portfolio.

The decision was approved at a board meeting held on October 14, with the merger expected to be completed within this year. Through the consolidation, SKC will secure approximately KRW 380 billion (approximately US$267 million or CNY 1.90 billion), including SK Enpulse's cash holdings and proceeds from its recent business divestitures. The funds will be used to invest in advanced semiconductor packaging technologies, particularly glass substrate commercialization, as well as in other high-value materials businesses. SKC also plans to allocate part of the proceeds to reduce debt and improve financial soundness.

Since 2023, SKC has been actively rebalancing its semiconductor materials portfolio. As part of this strategy, SK Enpulse has sold off its fine ceramics, wet chemicals and cleaning, CMP pad, and blank mask divisions, while its back-end equipment operations were spun off into a new entity, i-SEMI, and integrated with ISC, SKC's subsidiary specializing in test sockets and semiconductor components.

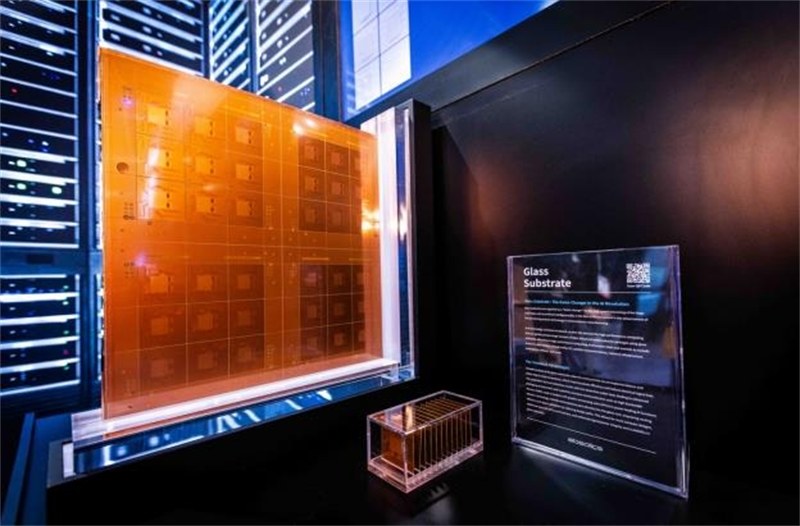

Following the merger, SKC's semiconductor business will focus on two core pillars: ISC's back-end test and component solutions, and Absolics, SKC's U.S.-based subsidiary currently advancing glass substrate commercialization in Georgia. This structure is designed to enhance SKC's competitiveness in high-value semiconductor packaging materials and establish a stronger presence in next-generation chip substrate technologies.

An SKC spokesperson said the merger and divestment of non-core businesses mark the completion of the company's portfolio transition, adding that the move will "bolster financial stability while creating new growth opportunities in the advanced semiconductor packaging sector."

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday