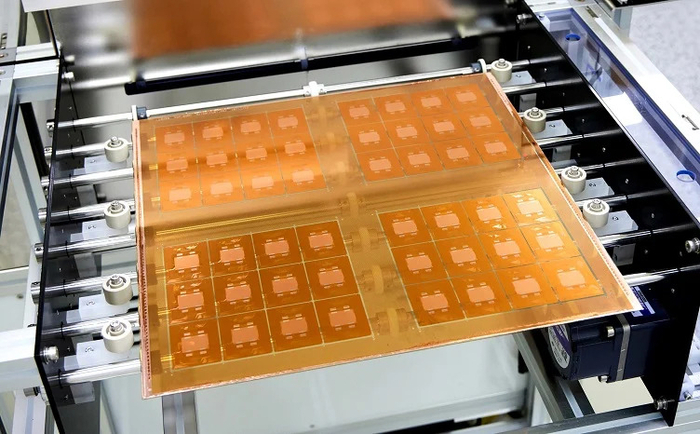

Absolics, a subsidiary of South Korea's SKC, is ramping up production of semiconductor glass substrates in a move signaling its readiness for high-volume manufacturing. According to industry sources on July 3, the company is entering a “ramp-up” phase, increasing procurement of materials and components for its production lines by more than 60% in the second half of 2025. The expansion comes as Absolics prepares to transition from sample-level deliveries to mass production for key customers.

The company's purchasing team is expected to visit South Korea shortly to finalize procurement terms with suppliers including FNS Tech, Philoptics, Samyoung Purification, and YCC. Absolics is also planning facility expansion, with equipment orders likely to be placed by the end of the year to accommodate rising demand.

Industry insiders interpret this as a sign that Absolics is nearing the start of volume shipments, having already cleared customer evaluations with small-batch samples. Growing demand for glass substrates and improved technical readiness are prompting the company to scale up output and reduce process errors to improve yields. This also indicates Absolics may be close to the "pre-qualification" stage with major customers such as AMD and Amazon Web Services.

Absolics has recently strengthened its financial position, securing $50 million in loans in Q1 2025 and receiving a $40 million grant under the U.S. CHIPS Act in May. It is also pursuing a capital increase from major shareholders SKC and Applied Materials. With this funding, the company aims to invest heavily in production capability and talent acquisition to support its transition to high-volume manufacturing (HVM).

An industry source familiar with the matter said, “Absolics now has the financial muscle to invest not only in equipment and materials, but also in workforce expansion. Discussions around a shift to full-scale mass production are already underway.”

Meanwhile, Intel appears to be reconsidering its approach to glass substrates. According to ComputerBase via Wccftech, Intel—which previously aimed to develop glass substrate technology in-house—is now reportedly planning to shift toward external sourcing. The change is seen as part of a broader strategic pivot, enabling the company to concentrate on its core strengths in CPU design and manufacturing.

Outsourcing glass substrates is expected to help Intel reduce risk, accelerate product rollouts, and offer more flexibility in supplier selection. However, it remains unclear how much internal development Intel will retain going forward.

The news comes as South Korean firms take a more prominent role in the glass substrate market. According to The Korea Herald, Absolics may become the first company to commercialize glass substrates. Samsung Electro-Mechanics has also begun operating a pilot line in Sejong and plans to adopt glass substrate interposers for advanced semiconductors by 2028.

In addition, Intel is reportedly shifting its foundry strategy away from its 18A node in favor of the 14A process for new clients, as it seeks to gain competitive ground against TSMC. While 18A will still be used internally—for products such as Panther Lake and Clearwater Forest—the company may offer 14A to external customers if sufficient demand is secured. Reuters reports that 18A-based chip production will continue for existing commitments, including limited volumes for Amazon and Microsoft.

Together, these developments highlight a realignment in the advanced packaging landscape—one in which Korean manufacturers are gaining momentum just as Intel rethinks its in-house ambitions.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday