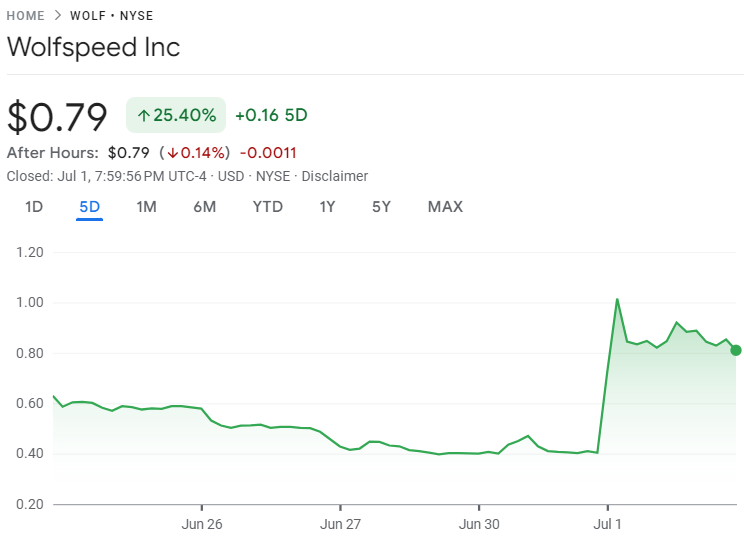

On June 30, U.S. silicon carbide (SiC) leader Wolfspeed voluntarily filed for Chapter 11 bankruptcy protection, initiating a major restructuring plan aimed at reducing debt and restoring financial stability. The company expects to complete the process by the end of the third quarter of 2025. Following the bankruptcy filing announcement, Wolfspeed’s shares surged over 90% in pre-market trading on July 1.

Wolfspeed has entered into a Restructuring Support Agreement (RSA) with key stakeholders, including holders of over 97% of its senior secured notes, more than 67% of its convertible notes, and the U.S. subsidiary of Japan's Renesas Electronics. As part of the deal, Renesas has agreed to convert a $2.062 billion deposit—initially a prepayment for SiC supply—into convertible notes, common shares, and warrants. The Japanese chipmaker expects to record a loss of approximately 250 billion yen (about $1.67 billion) in its financial statements for the six-month period ending June 30, 2025.

Following the restructuring, Wolfspeed projects a 70% reduction in total debt—approximately $4.6 billion—and a 60% drop in annual cash interest expenses. This move comes amid continued losses driven by weak demand in the EV and industrial sectors, and intense pricing pressure from Chinese SiC competitors such as TanKeBlue and SICC.

Despite recent cost-cutting efforts, including a 20% workforce reduction in late 2024 and factory closures in early 2025, Wolfspeed has struggled to return to profitability. Operations and customer deliveries will continue as usual throughout the Chapter 11 process, and the company has filed standard motions to maintain employee pay and vendor relationships without disruption.

CEO Robert Feurle emphasized that the restructuring will strengthen Wolfspeed's capital structure and help accelerate execution of its long-term strategy. "With a stronger financial foundation, we will be better positioned to meet rising global demand for energy-efficient SiC technology," he said. He also highlighted support from lenders and the strategic value of Wolfspeed's fully automated 200mm wafer fab.

Founded in 1987 as a division of Cree, Wolfspeed has become the world's largest SiC wafer producer, with over 30 years of experience and a global market share of 33.7% as of 2024. The company pioneered the world's first commercial SiC wafer in 1991 and launched the first SiC MOSFET in 2011. Its SiC products—including power modules, MOSFETs, diodes, and bare dies—are widely used in EVs, renewable energy, industrial power, and data centers to boost efficiency and power density.

While the company still faces structural challenges in a competitive global market, the Chapter 11 filing marks a pivotal step in Wolfspeed's effort to reset its financial trajectory and preserve its leadership in the next-generation semiconductor materials space.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday