Wolfspeed Inc., a U.S. maker of silicon carbide (SiC) chips, has successfully completed its Chapter 11 restructuring, cutting total debt by about 70% and extending maturities to 2030. The company also lowered annual cash interest expenses by roughly 60%, exiting bankruptcy with what it described as significantly improved financial stability.

The court-approved plan reduces Wolfspeed's debt from $6.5 billion to around $2 billion and includes moving its legal base from North Carolina to Delaware. Old shares have been suspended from trading and are scheduled to be delisted on October 10. Under the reorganization, creditors will own the majority of the new equity, while existing shareholders will retain only 3–5%.

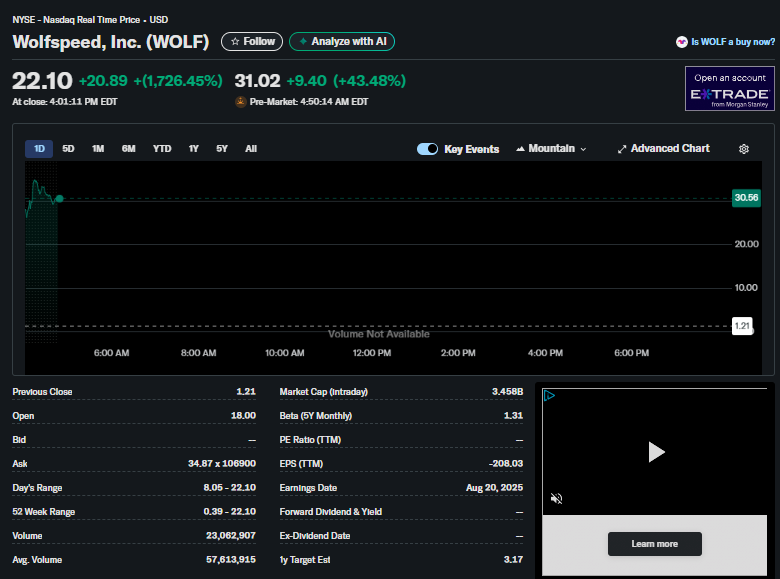

The restructuring news triggered a surge of speculative trading, sending Wolfspeed's stock price up as much as 1,726% on Monday before paring some gains. Trading was halted several times during the rally. At publication time, shares were still up more than 1,100%, changing hands at around $15.

Wolfspeed also added five new directors to its board, including Mike Bokan, formerly senior vice president of worldwide sales at Micron, and Eric Musser, who is set to retire this year as president of Corning.

CEO Robert Feurle said the completion of the restructuring marked "a new era" for the company, underpinned by a vertically integrated 200mm SiC manufacturing facility and strengthened liquidity. He emphasized that Wolfspeed is well-positioned to capitalize on growing demand in end markets such as AI, electric vehicles, industrial power, and energy.

"We are entering this new chapter with renewed energy and a stronger financial foundation," Feurle said. "Our mission remains to deliver cutting-edge silicon carbide solutions and ensure Wolfspeed stays at the forefront of the industry."

Wolfspeed filed for Chapter 11 protection in June after warning of going-concern risks, citing weak demand and uncertainty linked to U.S. trade policy. With its restructuring complete, the company said it has sufficient liquidity and a self-funded business plan supported by free cash flow, aiming for sustainable growth built on a secure domestic supply chain.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday