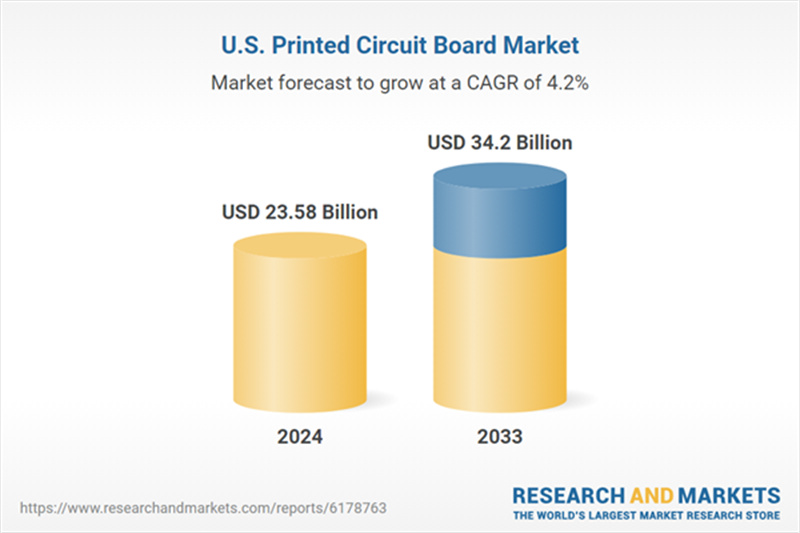

A new report titled "United States Printed Circuit Board Market Report by Type, Substrate, End Use, States and Company Analysis 2025–2033" was recently published on ResearchAndMarkets.com. According to the report, the U.S. PCB market is expected to grow from USD 23.58 billion (≈167.4 billion CNY) in 2024 to USD 34.2 billion (≈242.7 billion CNY) in 2033, representing a CAGR of 4.22 percent during 2025–2033.

Industry growth is being powered by booming demand for electronics, surging production of electric and autonomous vehicles, advances in flexible and high-density PCB technology, and rising investments in 5G, artificial intelligence, cloud computing, and renewable energy systems.

Electronics, Automotive, and AI Surge Push PCB Demand to New Highs

Consumer electronics remain a major driver of PCB consumption, with wearables, laptops, tablets, and smartphones requiring increasingly dense and compact circuitry. The expansion of smart home devices and IoT applications across residential, commercial, and industrial sectors is further accelerating demand for multilayer boards.

The automotive sector—particularly electric vehicles and next-generation autonomous platforms—continues to boost U.S. PCB usage. Modern vehicles require complex boards for ADAS, infotainment, power management systems, and sensor integration. As electrification advances, the number of PCBs per vehicle is steadily increasing.

The rollout of 5G networks and rapid adoption of AI-driven applications also require high-speed, high-frequency PCBs capable of handling large data volumes with minimal signal loss. From data centers to industrial automation, these technologies demand more sophisticated board designs and improved reliability.

Aerospace, defense, and renewable energy projects are similarly driving sustained investment in advanced electronic systems, supporting long-term PCB industry momentum.

Key Challenges: Supply Chain Risks and Global Competition

Despite strong outlook, the U.S. PCB market faces structural challenges. Manufacturers remain heavily dependent on imported materials such as laminates, copper foil, and specialty chemicals. Geopolitical tensions, natural disasters, or shipping disruptions can increase costs, delay production, and weaken supply stability.

Intense competition from lower-cost overseas PCB suppliers also pressures U.S. manufacturers to move up the value chain. Domestic producers must invest continuously in R&D, automation, and quality control—raising operating costs and challenging smaller firms.

Regional Markets: California, Texas, New York, and Florida Lead Growth

California remains the largest state-level PCB market, supported by Silicon Valley's electronics and semiconductor ecosystem. Texas follows closely, driven by industrial electronics, aerospace, and EV manufacturing. New York maintains strong demand from data centers, telecommunications, fintech, and defense electronics. Florida continues expanding in aerospace, medical devices, and robotics.

Recent Industry Developments

In August 2025, leading material supplier Ventec International announced a USD 17 million (≈120.7 million CNY) investment to launch a new Thailand facility in 2026, enhancing support for automotive and aerospace clients in the U.S. and Asia.

In July 2025, major U.S. manufacturer TTM Technologies acquired a 750,000-square-foot site in Eau Claire, Wisconsin, and secured additional land in Penang, Malaysia, to expand advanced PCB production for data-center networking applications.

In June 2025, global electronics manufacturer Jabil unveiled a multi-year USD 500 million (≈3.55 billion CNY) program to expand U.S. manufacturing capacity for cloud computing and AI data-center hardware, with operations scheduled to begin by mid-2026.

Key Companies Covered in the Report

Leading U.S. manufacturer Advanced Circuits Inc.

Global PCB leader Zhen Ding Technology Holding Limited

Major Taiwanese supplier Unimicron Technology Corporation

European electronics group Wurth Elektronik GmbH & Co. KG

German precision manufacturer Becker & Muller Circuit Printing GmbH

Advanced U.S. fabricator Murrietta Circuits

Japanese flexible-PCB giant Nippon Mektron Ltd.

Global trading conglomerate Sumitomo Corporation

Leading U.S. producer TTM Technologies Inc.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday