A leading global PCB manufacturer with a market cap of approximately $3 billion, TTM Technologies, Inc. (NASDAQ: TTMI), recently reported strong first-quarter results alongside an insider share sale by a top executive.

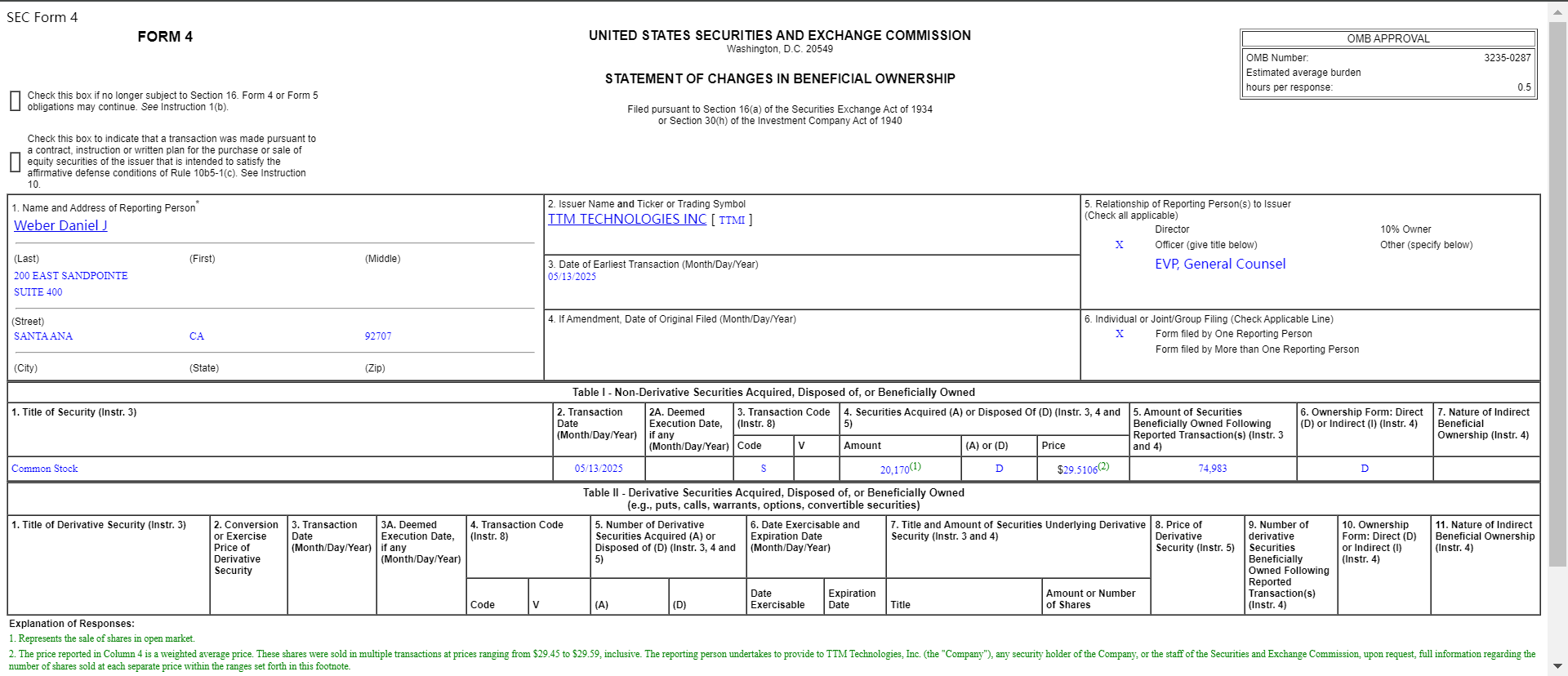

According to a recent SEC filing, Daniel J. Weber, Executive Vice President and General Counsel at TTM, sold 20,170 shares on May 13, 2025, at an average price of $29.51, totaling roughly $595,228 (approximately 4.29 million yuan). The transaction took place near the stock's 52-week high of $30.41. Following the sale, Weber retains 74,983 shares in the company. The shares were sold on the open market at prices ranging from $29.45 to $29.59.

The sale comes amid strong stock performance—TTM shares have gained nearly 65% over the past year—and a robust Q1 earnings report. For the first quarter of 2025, TTM posted revenue of $648.7 million (approximately 4.68 million yuan), up 14% year-over-year and above analyst expectations of $621.9 million. GAAP net income surged 208% year-over-year to $32.2 million (approximately 232 million yuan), or $0.31 per share. On a non-GAAP basis, net income reached $52.4 million, or $0.50 per share—a Q1 record for the company.

TTM's performance was driven by strong demand across its core end markets, particularly Aerospace & Defense, which accounted for 47% of total sales and grew 15% year-over-year thanks to a $1.55 billion project backlog. Data center computing and networking also posted strong growth, up 15% and 53% respectively, fueled by rising AI-related and switching demand.

The company maintained double-digit non-GAAP operating margins for the third consecutive quarter, reaching 10.5%, up 340 basis points year-over-year—demonstrating operational efficiency. TTM also reported ongoing progress at its facilities in Penang, Malaysia and Syracuse, New York, with the Penang site expected to break even by Q3 2025.

Looking ahead, TTM expects Q2 revenue between $650 million and $690 million, and non-GAAP EPS of $0.49 to $0.55.

In addition, TTM announced on May 9 a new $100 million (approximately 721 million yuan) share repurchase program, authorized through May 2027. “Given the company's solid cash flow generation and strong balance sheet, we believe repurchasing shares is a prudent use of capital,” said CFO Dan Boehle. The program adds flexibility while strategic acquisitions remain a top priority.

TTM also confirmed the retirement of founder Kent Alder from its Board of Directors, marking the end of an era for the company.

Despite new tariffs, TTM expects minimal direct revenue impact and maintains a positive outlook for the remainder of 2025.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday