Sony Group is reportedly considering spinning off its semiconductor business, Sony Semiconductor Solutions (SSS), through an IPO as early as this year, according to multiple sources cited by Bloomberg. The potential move would allow Sony to concentrate more of its operational resources on its fast-growing entertainment segments, including gaming and music.

Sources say Sony is exploring a “partial spin-off” structure, where it would retain a minority stake in the chip unit while distributing the majority of shares to existing shareholders. The plan, if finalized, would mark another step in Sony's ongoing efforts to streamline operations and unlock shareholder value, following a similar approach it is taking with Sony Financial Group.

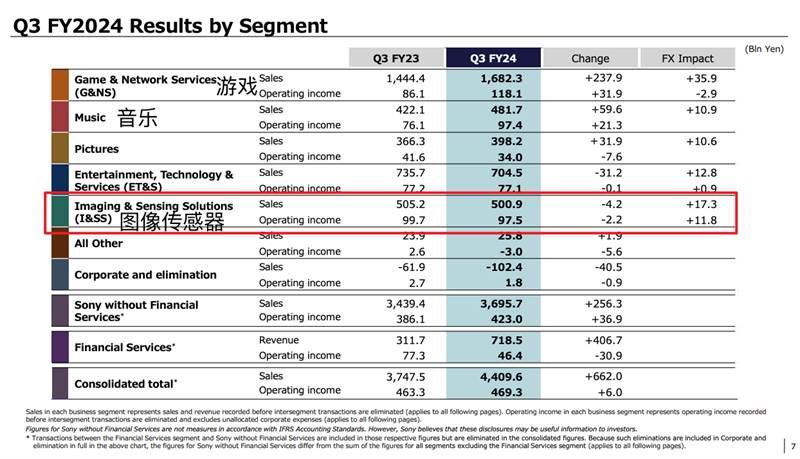

Sony's semiconductor arm is best known for producing high-end image sensors used in smartphones from Apple, Xiaomi, and other manufacturers. The company currently holds a 53% global market share in image sensors by value and aims to increase that to 60% this year. However, the segment has recently underperformed, with its operating profit margin falling from around 25% to just over 10%. In contrast, Sony's gaming and music businesses recorded double-digit profit growth last quarter.

Industry analysts note that the chip division requires significant and continuous investment to maintain its leadership, making a spin-off attractive for both capital-raising and more agile decision-making. However, the outlook for the semiconductor industry remains uncertain due to weak global smartphone demand, heightened U.S.–China trade tensions, and the return of U.S. tariffs under former President Trump.

While a spokesperson for Sony declined to comment on market speculation, the company is expected to release its FY2024 earnings and FY2025 guidance on May 14. Sony's U.S.-listed ADR rose 1.24% to close at $25.28 on April 28 following the news.

This isn't the first time a break-up of Sony's business has been proposed. Activist investor Dan Loeb previously urged the company to spin off non-core businesses like finance to unlock billions in value, though Sony resisted at the time. Loeb's Third Point fund exited its Sony position in 2020.

A spin-off of Sony's semiconductor unit, if realized, could provide the business with greater flexibility to respond to market shifts while helping the parent company sharpen its strategic focus on higher-growth, consumer-facing sectors.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday