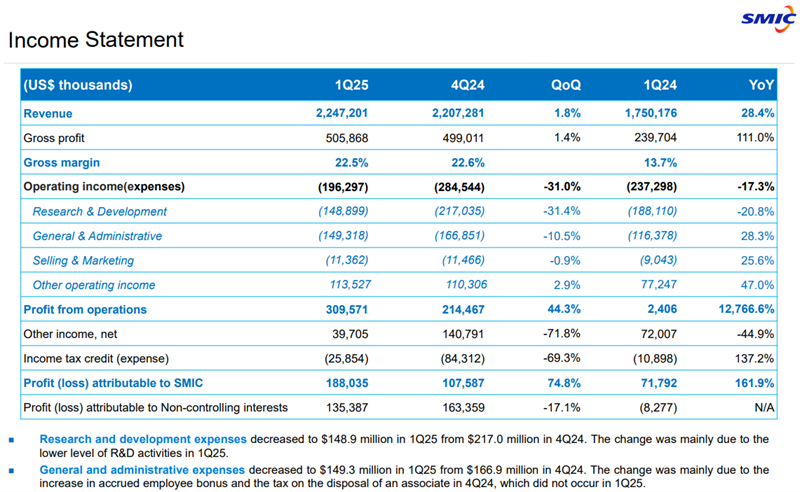

Semiconductor Manufacturing International Corporation (SMIC), China's largest foundry, posted a staggering 12,766.6% year-on-year increase in operating profit for Q1 2025, reaching $395.7 million, driven by record-high quarterly revenue of $2.247 billion—a 28.4% year-on-year rise. The company's gross margin held steady at 22.5%, while capacity utilization rose to 89.6%, signaling strong operational momentum.

The surge came despite global macroeconomic uncertainties and rising geopolitical pressures on the semiconductor supply chain. Revenue growth was fueled by robust demand in consumer electronics (40.6%), smartphones (24.2%), and automotive and industrial applications, which grew to 9.6% of total sales. By geography, revenue from the U.S. rose to 12.6%, up from 8.9% in the previous quarter, while China's share declined to 84.3%.

However, SMIC struck a cautious tone for the second quarter. Co-CEO Zhao Haijun warned that sales are expected to decline by 4%–6% sequentially due to production disruptions from unspecified issues. Gross margin is projected to narrow to between 18% and 20%. The announcement sent SMIC shares plunging 11% in Hong Kong on Friday, the sharpest drop in over a month.

Despite the near-term headwinds, SMIC reaffirmed its full-year capital expenditure plan of $7.5 billion, with first-quarter capex totaling $1.415 billion. R&D spending reached $148.9 million in Q1. The company emphasized its commitment to enhancing resilience and maintaining focus on core operations amid what it described as a year of “opportunities and challenges.”

As of Q1, 12-inch wafers accounted for 78.1% of SMIC's total wafer revenue, with total shipments reaching 2.29 million 8-inch-equivalent wafers. The company's production capacity also continued to expand, with monthly capacity increasing from 947,625 to 973,250 wafers quarter-over-quarter.

More than 75% of SMIC's capacity remains on mature nodes (45nm and above), though the company is advancing its technology roadmap. It currently operates seven fabs and is constructing three new 12-inch fabs. Industry sources report that SMIC is targeting 5nm chip development by 2025, although costs and yields remain significant challenges due to limited access to EUV lithography tools. Reports suggest SMIC's 5nm wafer yield may be only one-third of that of TSMC, with production costs up to 50% higher.

SMIC's cautious Q2 outlook mirrors that of China's second-largest foundry, Hua Hong, which also projected muted growth and declining margins amid continued market uncertainty. SMIC executives noted that while demand for AI-related chips remains strong, broader end-market growth for 2025 is expected to be moderate.

Amid looming global chip tariffs and intensifying competition, SMIC is focused on reinforcing its core capabilities and expanding domestic production, while closely monitoring policy shifts and customer demand trajectories in the second half of the year.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday