On July 1, global semiconductor distribution giants Arrow Electronics and WT Microelectronics each announced major strategic shifts, marking a turning point in the industry's evolution amid growing geopolitical and market pressures.

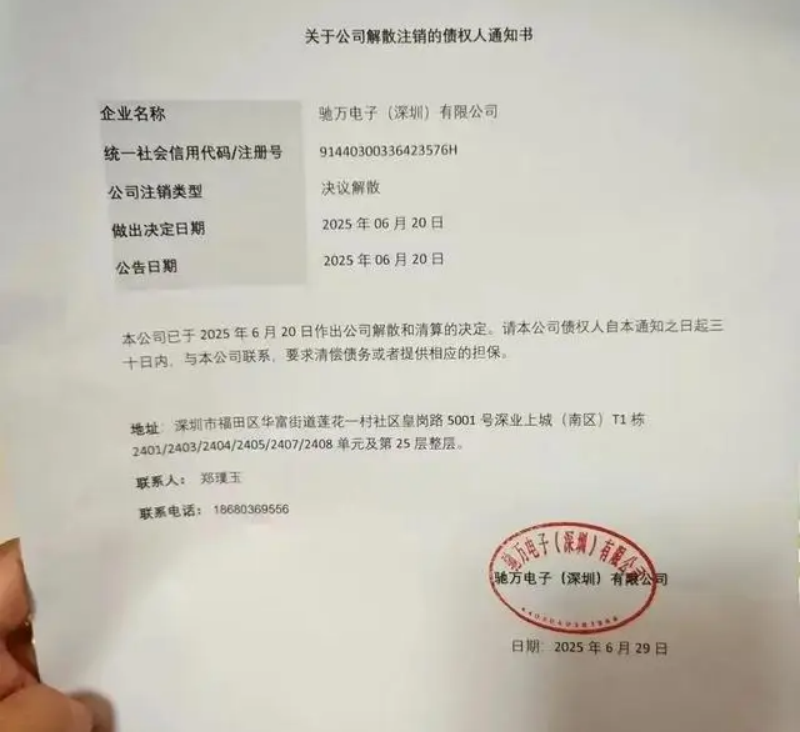

Arrow Electronics confirmed the dissolution of its China subsidiary, Chip One Stop Shenzhen Ltd., which officially began liquidation procedures on June 20, 2025. A formal “Creditors Notification Letter” circulated online signaled the closure of the unit, once a critical hub for Arrow's Asia-Pacific operations. Chip One Stop, founded in 2001 and acquired by Arrow in 2011, was a leading catalog distributor of electronic components with deep ties to over 3,000 suppliers and 28 million SKUs. Its brand portfolio included industry leaders such as Murata, Omron, Kyocera, ADI, NXP, Microchip, and Renesas.

The closure comes amid financial headwinds for Arrow. In Q1 2025, the company reported revenue of $6.81 billion, down 1.6% year-on-year, with core components sales plunging 8%. Europe saw the steepest drop at 16.8%, reflecting macroeconomic uncertainty and waning automotive demand. This marks a stark contrast to the company's 2022 record-high revenue of $37.1 billion.

Industry observers suggest that Arrow's restructuring reflects larger shifts in the semiconductor distribution landscape. In 2024, Taiwan's WT Microelectronics surpassed Arrow in revenue, breaking the dominance of U.S. and European players for the first time. As AI, EVs, and other emerging sectors demand faster, more localized supply chains, traditional distribution models face mounting pressure to adapt.

At the same time, WT Microelectronics announced the industry's largest reorganization in two decades, integrating three of its subsidiaries—Yosun, Panjit, and ATech—into WPI (WPG Group's flagship distributor). Beginning in 2026, the group will operate under a “dual-engine” model, led by WPI and Synnex Technology International .

The restructuring aims to enhance scale, operational efficiency, and competitiveness. WT Chairman Simon Yu will serve as CEO of the new group, while leadership from each subsidiary will take roles across product, sales, and global service coordination.

Since its founding in 2005, WT Microelectronics has built an extensive distribution network across 75 global locations, representing over 250 suppliers. The group is widely recognized as a “M&A king” in the chip distribution space, having used its “front-end autonomy, back-end integration” strategy to consolidate power across Asia. The latest consolidation reflects its goal to further streamline operations and scale global services.

As the chip distribution value chain undergoes realignment, major players are moving away from pure buy-sell models to offer added-value services such as inventory management and logistics-as-a-service (LaaS). This transformation is crucial to helping customers manage complexity in an increasingly fragmented global supply chain.

The dissolution of Arrow's Shenzhen subsidiary and WT's sweeping reorganization mark a watershed moment for the industry. Together, they signal not only the end of an era, but also the start of a new one—defined by consolidation, localization, and resilience against systemic global shocks.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday