Nvidia is planning to establish a new research and development center in Shanghai, according to a Financial Times report citing sources familiar with the matter. The move comes as the U.S. continues to tighten restrictions on advanced chip exports to China, impacting Nvidia's sales in one of its largest overseas markets.

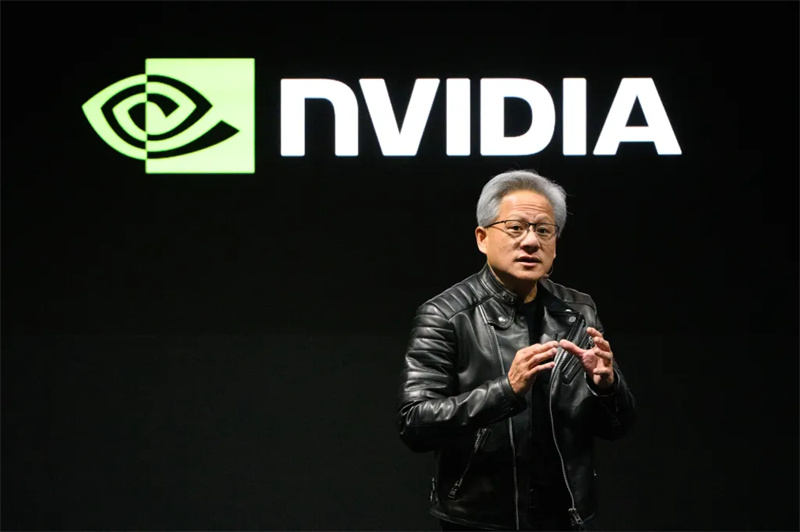

During a visit to Shanghai on April 18, Nvidia CEO Jensen Huang met with Mayor Gong Zheng and emphasized the importance of the Chinese market, citing its large scale, strong customer base, and robust industrial ecosystem. Huang noted that Nvidia's growth over the past 30 years has been closely tied to its deep presence in China.

According to insiders, Huang discussed the new R&D center plans during the meeting, and Nvidia has begun leasing a new office space in Shanghai to accommodate current employees and potential expansion. The new center is expected to focus on understanding local customer needs and developing technology that complies with U.S. export controls. However, the company will keep core chip design and production outside of China due to IP sensitivity.

“We are not sending any GPU designs to China to be modified to comply with export controls,” a Nvidia spokesperson told CNBC. The company reiterated that it is expanding its long-standing presence in China, not transferring sensitive technology.

The Shanghai team will also participate in global R&D initiatives, including chip design verification, product optimization, and autonomous driving technologies. Nvidia is actively hiring in Shanghai for roles tied to the next generation of deep learning hardware and globally competitive ASIC design.

One source said the Shanghai government has expressed initial support for the plan, while Nvidia is seeking U.S. government approval amid the complex legal environment.

Currently, Nvidia employs around 2,000 people in China, mostly in sales and support roles. Some sources noted that Nvidia has operated an R&D center in Shanghai for years and may simply be expanding into a new facility.

The push comes at a critical time. In April, the U.S. government placed Nvidia's China-specific H20 AI accelerator under export control, requiring a license for shipments. Nvidia disclosed a $5.5 billion charge tied to related inventory and supply chain costs, significantly affecting its China AI business.

Although China accounted for roughly 14% of Nvidia's 2024 revenue (around $17 billion), Huang warned that losing access to a market that could reach $50 billion in AI chip demand over the next two to three years would be a “tremendous loss.”

“If we completely exit a market, others will fill the gap. Huawei, for example, is very strong—they will step in,” Huang said during a recent event.

To retain market share, Nvidia is reportedly working on a modified version of the H20 chip, dubbed the L20, with reduced high-bandwidth memory and compute performance. It could launch as early as July. However, FT reports suggest Chinese tech giants like ByteDance, Alibaba, and Tencent are reluctant to order the L20 due to performance concerns.

Meanwhile, the Trump administration recently proposed a new export rule framework aimed at ensuring U.S. dominance in AI. The guidance warns companies globally against using Chinese AI chips due to potential export control violations.

A Chinese tech executive summed up the dilemma: “We're caught between using lower-performance Nvidia chips that support CUDA or switching entirely to Chinese chips and enduring the pain of a new ecosystem.”

As geopolitical tensions reshape the global AI landscape, Nvidia is striving to remain agile—reaffirming its commitment to the Chinese market while navigating tightening U.S. regulations.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday