On October 17, 2025, U.S. memory chipmaker Micron Technology (NASDAQ: MU) is planning to withdraw from the Chinese data center market by halting the supply of server chips to mainland customers, according to two people familiar with the matter. The decision comes after Micron's data center business failed to recover from a 2023 Chinese government ban that barred the company's products from use in critical information infrastructure, a move widely viewed as retaliation for U.S. export controls targeting China's semiconductor sector.

Micron was the first U.S. semiconductor firm to be targeted by Beijing's cybersecurity authorities. The company confirmed in a statement to Reuters that its data center division had been affected by the ban and reiterated that it "abides by applicable regulations where it does business."

Despite the retreat from China's data center segment, Micron will continue supplying chips to two Chinese customers with major data center operations outside the mainland, including Lenovo Group (HKEX: 0992), sources said. The company will also maintain shipments to automotive and smartphone manufacturers in China, which are not subject to the infrastructure ban.

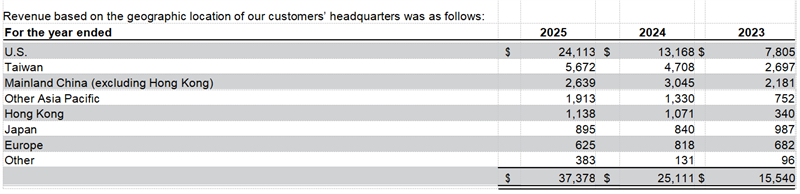

Micron derived about US$3.4 billion, or 12% of total revenue, from mainland China in its last fiscal year. However, the share has steadily declined — from 14% in fiscal 2023 to 12.1% in fiscal 2024, and further down to roughly 7.1% in fiscal 2025, according to the company's latest financial report. Micron noted that the Chinese government's decision "negatively impacted the company's ability to compete effectively in China and elsewhere.

Impact of the 2023 Ban

The May 2023 decision by the Cyberspace Administration of China (CAC) concluded that Micron's products failed its network security review and instructed Chinese critical infrastructure operators to cease procurement. The ban cost Micron access to the world's second-largest market for server memory, benefiting competitors Samsung Electronics, SK Hynix, and Chinese firms YMTC and CXMT, which have expanded rapidly with state support.

Investment in China's data centers surged ninefold to 24.7 billion yuan (US$3.4 billion) last year, according to government procurement records reviewed by Reuters, underscoring the market Micron is now exiting.

Still, robust global demand for AI-driven data centers has helped offset losses from China. "Micron will look for customers outside of China in other parts of Asia, Europe, and Latin America," said Jacob Bourne, an analyst at Emarketer. "China remains a critical market, but AI expansion worldwide gives Micron room to recover lost business elsewhere," he added.

Continued Presence and Legal Challenges in China

Despite its shrinking market share, Micron has continued investing in China, particularly at its Xi'an packaging and testing facility. In March 2024, the company broke ground on a new packaging and testing plant in Xi'an, expected to begin production in the second half of 2025. The expansion follows a 4.3 billion yuan investment announced in June 2023, signaling Micron's long-term operational commitment.

"Today's groundbreaking marks an important milestone in Micron's global assembly and test strategy," said Sanjay Mehrotra, Micron's president and CEO, during the ceremony. "We are proud of our more than 20 years of partnership in China and remain committed to supporting our customers and employees here."

At the same time, Micron has been entangled in a series of patent disputes with Yangtze Memory Technologies Corp. (YMTC) since late 2023. YMTC has filed multiple lawsuits in the U.S. and China alleging that Micron's 3D NAND and DDR5 DRAM products infringe on its patents. The cases, filed in California, Beijing, and Shanghai, seek injunctions, damages, and legal costs.

Broader U.S.-China Tech Tensions

Micron's difficulties reflect the deepening U.S.-China technology decoupling since Washington imposed sweeping export controls and sanctions on Chinese tech firms beginning in 2018. Beijing has responded with limited but targeted regulatory actions, including the Micron ban, as it seeks to bolster domestic chipmaking capacity.

Although Micron has strengthened ties in other markets, including the U.S. and Taiwan — which now account for over 70% of its revenue — its effective exclusion from China's fast-growing data center ecosystem underscores the cost of geopolitical fragmentation in the global semiconductor supply chain.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday