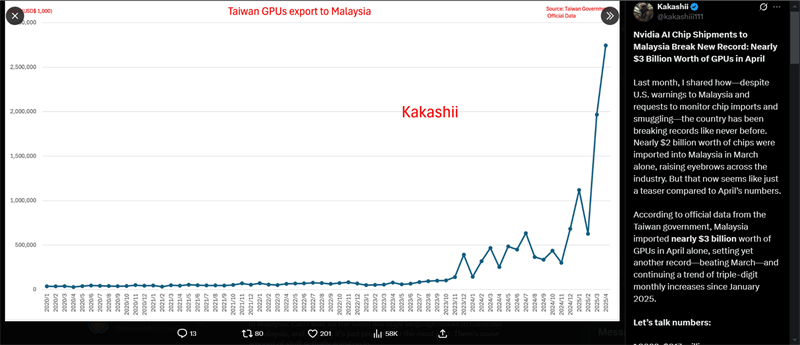

Malaysia's imports of high-performance GPUs from Taiwan surged to unprecedented levels in early 2025, sparking concerns in the United States over the potential rerouting of chips to circumvent export controls targeting China.

According to data cited by analyst @Kakashii and attributed to Taiwan's government, Malaysia imported $6.45 billion worth of AI-capable GPUs from Taiwan between January and April 2025—already surpassing the full-year total of $4.88 billion in 2024. Monthly import volumes have soared at triple-digit or even quadruple-digit year-on-year rates:

● January: $1.12 billion (+700% YoY)

● February: $626.5 million

● March: $1.96 billion (+3,400% YoY)

● April: $2.74 billion (+3,400% YoY)

The data suggests Malaysia's growing role as a key node in the global AI chip supply chain, especially ahead of the U.S. government's pending “AI Guardrails” rule, set to take effect on May 15, 2025. The rule caps the aggregate compute performance that each country in a designated group—including Malaysia—can import annually, with a limit equivalent to roughly 50,000 Nvidia H100 GPUs.

In light of this, industry watchers believe the surge may reflect efforts by Malaysian firms and intermediaries to stockpile GPUs before tighter restrictions come into force.

Discrepancies and Transparency Issues

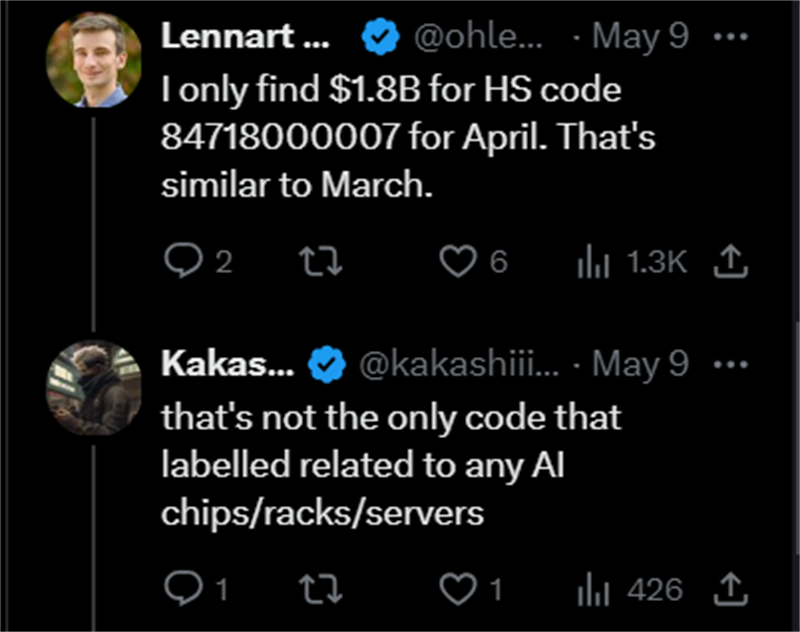

However, data discrepancies have emerged. Taiwan's Ministry of Economic Affairs, based on export classification code 8471.80.00.00-7 (which includes GPU servers), reported $4.88 billion in exports to Malaysia in the first four months of 2025—lower than the $6.45 billion cited by @Kakashii. Nevertheless, both sets of data show a sharp increase: the official figure still reflects a 514% year-on-year jump, and unit volumes rose over 100% to 8,761, with an average per-unit value of $557,000, indicating these are high-end AI GPUs.

Analysts note that Taiwan manufactures the majority of the world's advanced AI GPUs, while Malaysia serves as both a major assembly hub and growing consumer due to booming demand from its expanding data center industry.

U.S. Scrutiny and Nvidia's Disclosure Practices

The surge in Malaysia's imports is likely to attract scrutiny from U.S. regulators. Nvidia is expected to report $43 billion in revenue for its fiscal Q1 (February–April), and Malaysia's imports during this period—$5.33 billion—could account for over 12% of that total. Under SEC rules, companies must disclose any single country contributing more than 10% of total revenue.

Yet Nvidia may not report Malaysia explicitly. The company follows a billing-based disclosure model, listing revenue by invoice location, not by where products are physically delivered. This means Malaysia-originated shipments could be recorded under third countries, complicating transparency.

The issue echoes past concerns about Singapore, which was named in a 2023 U.S. probe into potential AI chip re-exports to China. Nvidia's Singapore revenue had soared to $7.7 billion in the quarter ending October 2024—18% of total revenue—even though Singapore later admitted that only about 1% of those GPUs physically entered the country.

Washington Pressures Kuala Lumpur

U.S. regulators have already taken notice. In March 2025, The Financial Times reported that the Biden administration urged Malaysia to monitor inbound shipments of high-end Nvidia GPUs, fearing onward smuggling to China. In response, Malaysia formed a joint task force with U.S. digital officials to enhance oversight of GPU flows and local data center deployments.

Malaysia's trade minister confirmed that Washington wants assurance that imported chips reach only authorized facilities and do not get diverted mid-shipment. This follows growing concerns that countries like Malaysia may be exploited as transshipment hubs to bypass restrictions on AI chip exports to China.

Booming Domestic Demand Complicates Picture

Still, analysts caution against assuming all imports are for re-export. Malaysia's domestic demand for AI infrastructure is growing rapidly. Recent major investments include:

● Nvidia and YTL Group: $4.3 billion AI data center in Johor (announced Dec 2023)

● Microsoft: $2.2 billion investment in AI/cloud infrastructure (May 2024)

● Oracle: $6.5 billion planned data center (Oct 2024)

● ByteDance and Google: Combined $4.1 billion in planned Malaysian AI facilities

As global tech giants pour capital into Malaysia's digital infrastructure, legitimate local demand for cutting-edge GPUs is surging in parallel with geopolitical scrutiny—leaving Malaysian trade at the center of the global AI chip storm.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday