As of May 14, 2025, Shenzhen-based chip equipment firm SiCarrier is seeking 20 billion yuan ($2.8 billion) in its first fundraising round, according to sources familiar with the matter. The company, which has close ties to Huawei, aims to become China's leading supplier of semiconductor manufacturing tools—surpassing local giants like Naura and AMEC.

Founded in 2021 and backed by the Shenzhen municipal government, SiCarrier was little known until this year, when it made headlines in China's semiconductor industry for its ambitious product roadmap. The startup is now seen as a key player in Beijing's efforts to build a self-sufficient chipmaking ecosystem, following sweeping U.S. export controls on advanced chips and equipment.

One source said the fundraising, which could conclude within weeks, involves the sale of a 25% stake in a SiCarrier unit that excludes its lithography assets. The unit is targeting a valuation of 80 billion yuan ($11 billion).

Proceeds will primarily support R&D. Chinese state-owned firms, government-backed funds, and private equity investors have reportedly shown interest, potentially making this one of the largest yuan-denominated fundraisings of the year.

SiCarrier has been under U.S. export restrictions since late 2024 due to its association with Huawei. The company declined to comment, while Huawei and the Shenzhen government said they are not affiliated.

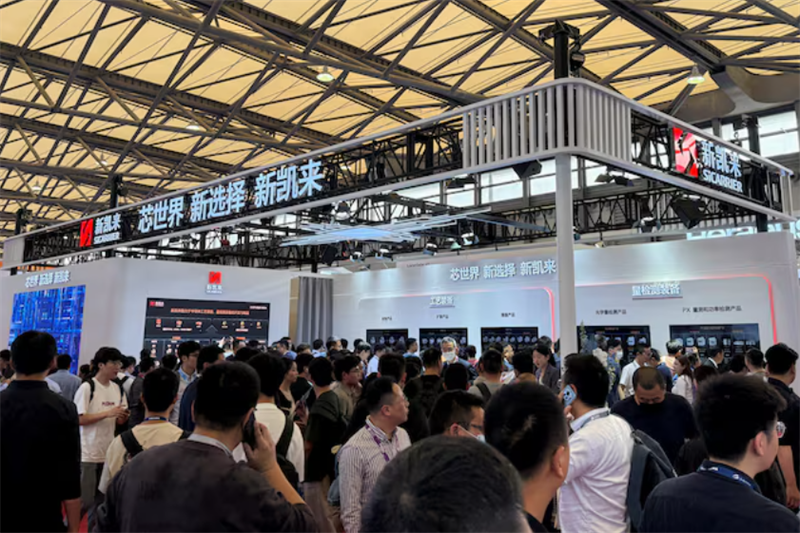

SiCarrier made its public debut at Semicon China in March 2025, showcasing over 30 semiconductor manufacturing tools—ranging from etching to inspection equipment—each named after Chinese mountains. Notably, lithography machines were not on display. While the company did not elaborate on the readiness of its products, sources say most are still under development and not yet production-ready. Analysts at Bernstein also questioned whether a firm established only in 2021 could have completed the lengthy validation processes required for such complex tools.

According to TechInsights, domestic suppliers accounted for just 11.3% of China's wafer fab equipment purchases last year, despite the country spending $128 billion on such tools since 2020. While SiCarrier's goals are ambitious, meaningful market share gains for Chinese equipment vendors could take years.

A Reuters review of 92 patents filed by SiCarrier and its parent company between October 2022 and March 2025 indicates a broad push into all major chipmaking tool segments—competing with global players such as KLA, Lam Research, and Tokyo Electron. Patents include technologies for wafer measurement, deposition, etching, and even deep ultraviolet (DUV) lithography components. The firm is also investing in AI-powered defect detection tools to improve yields—an area with no clear domestic leader, according to two sources.

To circumvent the lack of access to EUV tools, SiCarrier is also developing multi-patterning techniques. While used by TSMC and introduced by Intel in the 2010s, the method is seen as less efficient due to increased complexity and lower yields.

Despite government backing, industry insiders say SiCarrier faces hesitancy from potential customers. The company is widely believed to have originated from a Huawei unit, and some Chinese foundries are reportedly wary of using its tools over fears of leaking process data to Huawei. Several HiSilicon employees have been seconded to SiCarrier, further fueling those concerns.

"The challenge isn't just about technology," said one source. "It's about trust. Customers worry that Huawei could gain insight into their proprietary processes. Even if SiCarrier distances itself from Huawei, validation and iteration will still take years."

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday