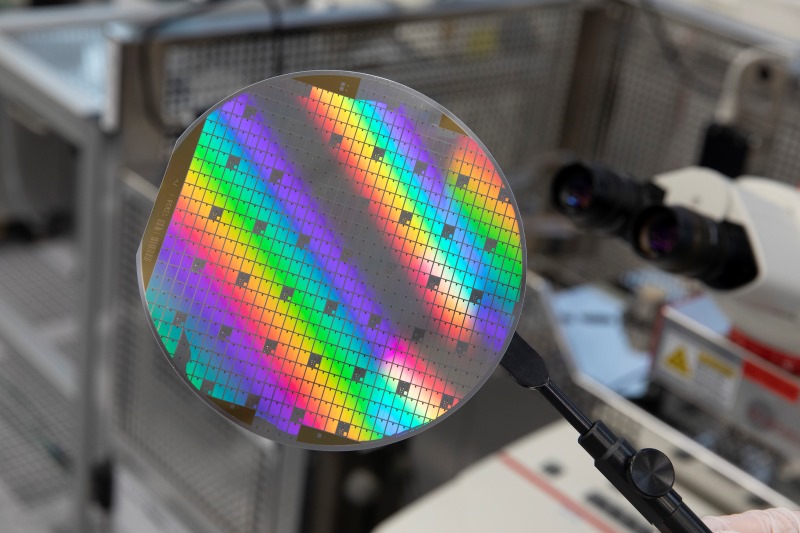

A leading European Tier 1 automotive supplier is reportedly planning to sell its 6-inch silicon carbide (SiC) wafer fabrication facility, signaling further shifts in the global SiC industry. While the company claims the move is part of an upgrade to 8-inch production, industry insiders believe it may be a strategic retreat from unprofitable operations under growing market pressure.

Sources indicate that the slowdown in vehicle electrification, competition in both China and the U.S., and rising tariff uncertainty are weighing heavily on European Tier 1 suppliers. The 6-inch SiC capacity reduction could present new outsourcing opportunities for Taiwanese firms such as Hon Hai's subsidiary Foxy Technology, GlobalWafers' affiliate Taisic, and others like PFC Device, Vanguard International Semiconductor, and Episil.

The sale comes amid a broader realignment of the SiC supply chain. In 2023, Chinese players broke key bottlenecks in SiC material output, drastically lowering costs and improving availability. This has reshaped the global competitive landscape, forcing weaker players—particularly those without cost advantage—toward exit strategies.

The Tier 1 supplier in question continues to control system integration and module design, key decision-making nodes in the SiC value chain. However, its move to offload wafer manufacturing may reflect internal restructuring aimed at focusing on higher-margin segments.

Europe's SiC industry, largely concentrated on wafer manufacturing and module development, has long relied on external raw materials. In contrast, China's supply chain is rapidly becoming vertically integrated. This structural difference has led to growing cross-border cooperation. Bosch and Infineon, for instance, have signed long-term SiC material supply agreements with China's TankeBlue and SICC. STMicroelectronics has also partnered with Sanan Optoelectronics to build a vertically integrated fab in Chongqing.

Despite access to lower-cost Chinese raw materials, European firms have struggled to turn a profit in SiC wafer manufacturing due to intense price competition. Industry analysts see the planned fab sale as part of a broader trend—European suppliers shedding low-margin assets while pivoting toward flexible partnerships with Chinese OEMs and cost-efficient Asian contract manufacturers.

As the global SiC industry enters a phase of deep restructuring, Taiwan-based companies are eyeing this capacity shift as a key opportunity. Whether European Tier 1s can maintain their edge in high-value system design and integration will be crucial to their future relevance in the rapidly evolving power electronics ecosystem.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday