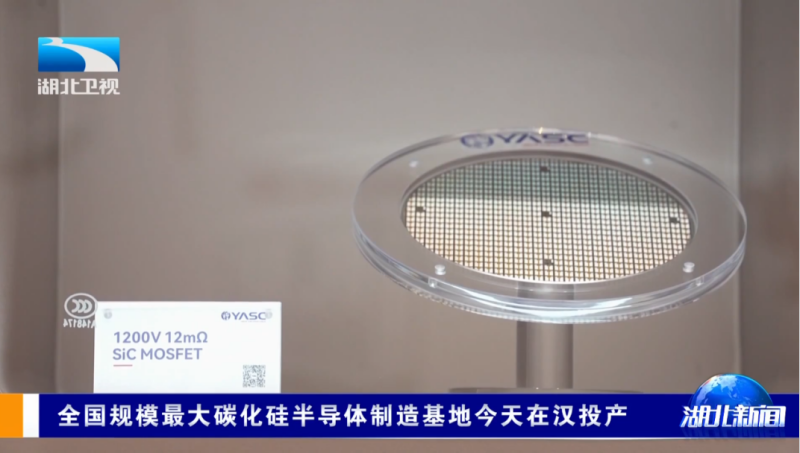

On May 28, China's largest silicon carbide (SiC) wafer facility officially commenced production in Wuhan's Optics Valley Science Island. The plant, operated by YOFC Advanced Semiconductor (a subsidiary of fiber-optic giant YOFC), rolled out its first 6-inch SiC wafer, marking a major milestone in China's push to localize critical power components for new energy vehicles (NEVs).

According to YOFC President and Chairman of YOFC Advanced, Zhuang Dan, the SiC chips produced at the facility will serve as the main drive chips in NEVs—akin to a fuel car's engine or a human heart. The plant is designed to produce 360,000 wafers per year, enough to supply drive chips for up to 1.44 million EVs annually, positioning it as the largest SiC wafer fab in the country.

SiC chips are favored in EV applications due to their ability to operate reliably under high temperatures and voltages. As EV charging systems evolve to handle higher voltages and longer ranges, demand for SiC power components has surged globally.

"Despite just starting operations, our first chips have already achieved a yield rate of 97%, reaching advanced international standards," said Li Gang, General Manager of the Wuhan fab. He credited the performance to the site's industry-first A3-grade overhead transport system, which enables full automation across production, handling, and dispatching, allowing the 12,000-square-meter facility to operate with just 20 workers per shift.

Li noted that the fab is already working with top global automakers, with the first SiC chip model set to enter vehicle testing next month. Nearly 10 models are under validation, with volume shipments expected in the coming months.

YOFC entered the SiC sector in 2022 with a ¥20 billion (approx. $2.75 billion) investment in the Wuhan facility. Construction began in September 2023 and was completed in just 21 months—an execution pace on par with global semiconductor leaders like TSMC.

Zhuang highlighted that the fab has attracted over 20 supporting suppliers and partners to the surrounding area and has launched R&D collaborations with institutions such as Jiufengshan Lab and HGTech, also based in Optics Valley.

Wuhan's Optics Valley has rapidly developed into a national SiC hub. The region is now home to more than 50 compound semiconductor companies, including billion-yuan projects like YOFC Advanced and XDL Advanced Materials. Over 30,000 technical talents are engaged in a growing ecosystem spanning materials, device fabrication, and testing, forming a complete SiC industry chain.

In stark contrast, Japan's Renesas Electronics has quietly exited its SiC power semiconductor plans. The company has disbanded its SiC team at its Takasaki plant in Gunma Prefecture and scrapped plans to begin SiC chip production in early 2025.

Renesas CEO Hidetoshi Shibata stated in February that “market conditions are extremely challenging,” citing weakening EV demand, increased capacity from Chinese producers, and falling chip prices. Renesas determined the project was unlikely to reach profitability.

Market data from Fuji Keizai shows that the global SiC market is projected to grow only 18% in 2024 to ¥391 billion ($2.69 billion), significantly below earlier forecasts of 27%. The slowdown has been linked to reduced EV subsidies in Europe, slower EV sales, and a shift by Chinese automakers toward domestic chip suppliers.

Other global SiC players are also facing headwinds. ROHM posted a net loss in fiscal 2024—the first in 12 years—due to heavy SiC investments. STMicroelectronics, a supplier to Tesla, has seen its share price tumble more than 50% this year. U.S.-based Wolfspeed is reportedly preparing to file for bankruptcy protection amid mounting financial pressure.

As China's SiC industry ramps up capacity, global players may be forced to reconsider their positions in a rapidly evolving and increasingly competitive landscape.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday