China emerged as the fastest-growing—and now largest—market for semiconductor production equipment last year, underscoring its rapid push to expand domestic chipmaking capacity amid geopolitical headwinds and export controls. According to newly released industry data, Chinese firms spent $49.6 billion on chip manufacturing tools in 2024, a 35% surge from $36.6 billion in 2023.

This sharp increase dwarfed spending growth in other regions. South Korea followed with $20.5 billion (up 3%), led by Samsung and SK Hynix, while North American firms including Intel invested $13.7 billion (up 14%). Japan and Europe, by contrast, saw spending declines of 1% and 25%, respectively.

The surge highlights China's intensifying efforts to localize critical semiconductor capabilities, with heavy investment in tools such as lithography and etching systems—particularly as access to advanced foreign technology faces increasing restrictions.

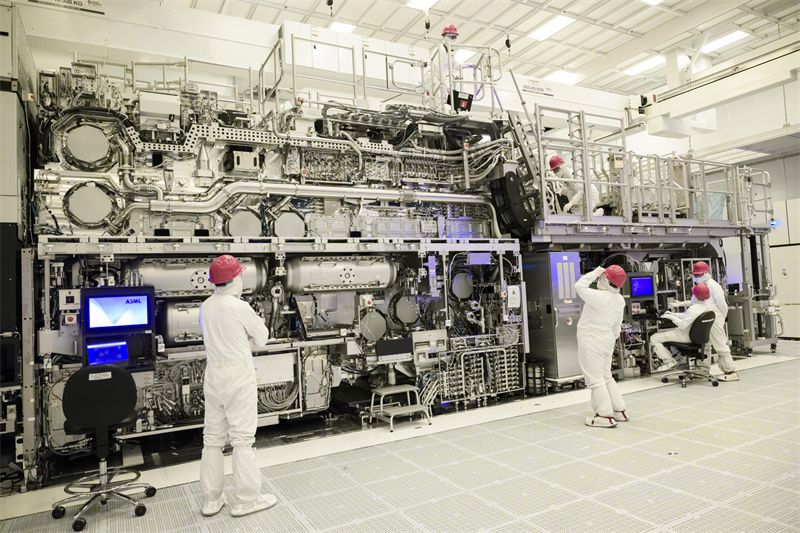

Meanwhile, Taiwan Semiconductor Manufacturing Co. (TSMC), the world's largest contract chipmaker, is still evaluating when to deploy ASML's next-generation high-numerical-aperture (High-NA) extreme-ultraviolet (EUV) lithography systems in future process nodes. The tools, priced at nearly $400 million each, offer superior resolution and throughput but come at nearly double the cost of existing Low-NA EUV machines.

When asked whether TSMC would adopt High-NA EUV for its upcoming A14 (1.4 nm) node and its enhanced variants, Kevin Zhang, senior vice-president of business development, said the company “has not yet found a compelling reason.” Zhang added that “even without High-NA, the A14 enhanced node will deliver significant performance gains,” and that engineering teams are focused on extending the use of existing Low-NA systems.

TSMC previously ruled out High-NA for its A16 (1.6 nm) roadmap, citing pricing concerns.

In contrast, Intel has confirmed it will use High-NA EUV for its forthcoming Intel 14A process as it seeks to reinvigorate its foundry ambitions. Customers, however, may still opt for mature Low-NA solutions.

So far, ASML has shipped five High-NA machines—each weighing about 180 tons—to Intel, TSMC, and Samsung. ASML CEO Christophe Fouquet said customers will begin evaluating the tools for high-volume production readiness between 2026 and 2027, followed by potential deployment at their most advanced nodes.

Fouquet noted that AI continues to drive strong demand across the industry. Despite concerns over newly announced U.S. tariffs, ASML expects 2025 and 2026 to be growth years, maintaining a full-year gross margin forecast of 51–53%. By 2030, the company aims to reach €44–60 billion in annual sales, with gross margins rising to 56–60%.

As TSMC weighs the economics of cutting-edge tools, China's decisive surge in equipment procurement highlights its growing centrality in the global semiconductor supply chain—and its determination to close the technological gap.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday