China's Ministry of Commerce (MOFCOM) has announced an anti-dumping investigation into U.S.-made analog chips, marking a significant step in Beijing's efforts to protect its domestic semiconductor industry as technology frictions with Washington deepen.

According to an official statement released on September 13, MOFCOM initiated the probe after receiving a petition on July 23 from the Jiangsu Semiconductor Industry Association on behalf of Chinese analog chip manufacturers. The petition alleged that U.S. analog chips had been sold in China at unfairly low prices, harming the local industry.

Following a preliminary review, MOFCOM concluded that the petition met the requirements of China's Anti-Dumping Regulations, including evidence of material injury to domestic producers. The probe will cover imports of certain analog integrated circuits (ICs) from the United States—including commodity interface ICs and gate driver ICs—produced using 40nm and above process technologies. The investigation period runs from January 1 to December 31, 2024, with industry injury data examined from 2022 through 2024.

Industry sources note that between 2022 and 2024, imports of the targeted analog chips from the U.S. into China rose 37%, while prices fell 52%, creating downward pressure on domestic pricing. If dumping is confirmed, Chinese authorities may impose punitive tariffs on U.S. suppliers.

The move comes just one day after the U.S. Department of Commerce's Bureau of Industry and Security (BIS) added 23 Chinese entities—including 13 semiconductor-related firms—to its export control Entity List, citing national security concerns. Beijing strongly condemned the decision, calling it an abuse of export controls and a violation of global trade rules. A MOFCOM spokesperson warned that Washington was "politicizing technology and weaponizing trade," while China's Foreign Ministry accused the U.S. of "hegemonic bullying" and vowed countermeasures.

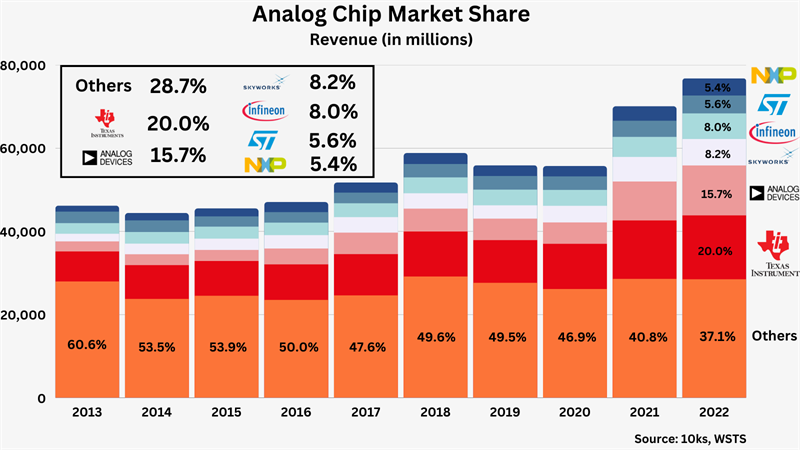

Analog chips, which process continuous signals such as sound, light, and temperature, are essential components in electronics ranging from smartphones and industrial equipment to automobiles. Despite China's status as the world's largest analog chip market—valued at around $45 billion in 2024 and representing nearly 60% of global demand—domestic suppliers hold only about 11% of global market share. The sector remains dominated by U.S. and European giants such as Texas Instruments, Analog Devices, Infineon, and NXP.

Texas Instruments alone generated $15.6 billion in revenue in 2024, compared with far smaller Chinese analog chipmakers, most of which focus on lower-end power management ICs. Recent reports also indicated that TI has notified customers of sweeping price hikes, with increases ranging from 10% to 25% on more than 60,000 models, and some products rising over 30%.

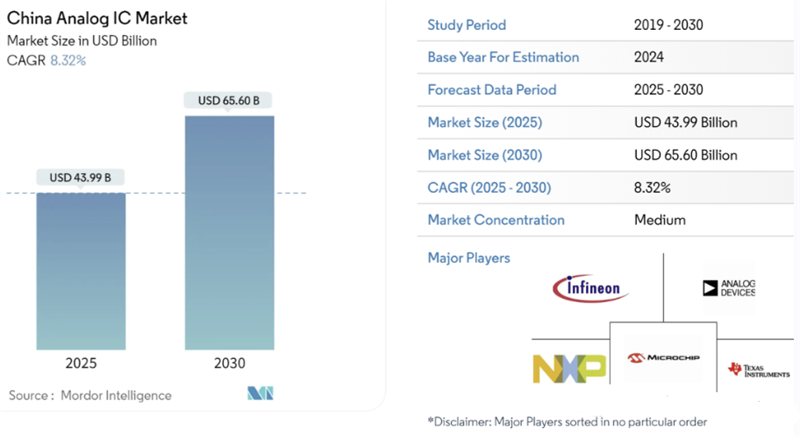

Analysts say the investigation could accelerate domestic substitution in China's analog IC market. Companies such as SG Micro and Naxin Micro have already achieved volume shipments of automotive-grade analog chips, while policy support and rising demand in automotive and industrial sectors are fueling growth opportunities.

Market research firm Mordor Intelligence forecasts that China's analog IC market will grow from $43.9 billion in 2025 to $65.6 billion by 2030, with a compound annual growth rate of 8.3%. However, U.S. and European suppliers are expected to remain dominant in the high-performance segment for the foreseeable future.

MOFCOM stressed that the anti-dumping probe is consistent with Chinese law and World Trade Organization rules. The ministry pledged to ensure a fair and transparent process, safeguard the rights of all parties, and issue a ruling based on objective evidence.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday