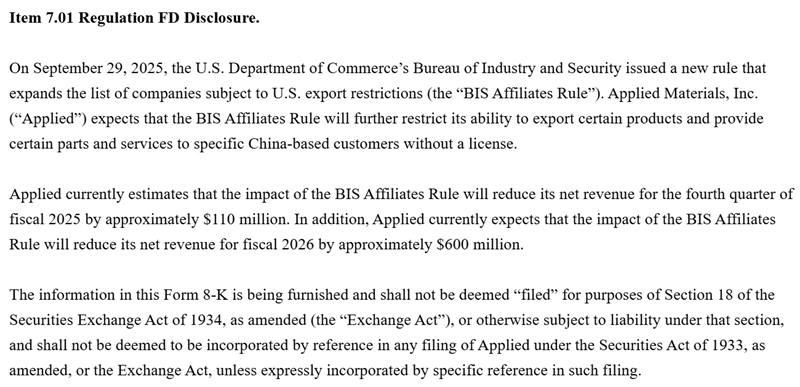

On October 2 local time, Applied Materials, one of the world's largest semiconductor equipment makers, disclosed in an SEC 8-K filing that new export restrictions issued by the U.S. Department of Commerce's Bureau of Industry and Security (BIS) could cut its revenue by approximately $110 million in the fourth quarter of fiscal 2025 and $600 million in fiscal 2026.

The BIS rule, published in the Federal Register on September 29, extends U.S. export controls to any foreign subsidiary in which a blacklisted entity holds a 50% or greater ownership stake, closing a loophole that previously allowed sanctioned firms to evade restrictions by creating new affiliates. The rule states that such measures are necessary to "effectively protect U.S. national security and foreign policy interests."

The move significantly broadens the scope of Washington's export restrictions, potentially affecting thousands of companies globally. Analysts believe the change primarily targets China's technology and semiconductor sectors, where blacklisted firms have used subsidiary networks to maintain access to critical U.S. technologies.

Applied Materials said the new rule will further limit its ability to export certain products and provide parts and services to specific China-based customers without a license. The company warned of a meaningful financial impact in both the short and medium term as it adjusts its operations to comply with the expanded restrictions.

Shares of Applied Materials fell about 3% in after-hours trading following the announcement. Rival chip equipment suppliers—including Lam Research, KLA, and ASML—have yet to issue similar statements.

Applied Materials, headquartered in Santa Clara, California, reported fiscal 2024 revenue of $27.18 billion, up 2.5% year over year, with third-quarter sales rising 8% to $7.3 billion, slightly above market expectations.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday