Nvidia has agreed to invest $5 billion in Intel and co-develop custom chips for data centers and PCs, marking a dramatic reshaping of industry alliances amid the AI boom.

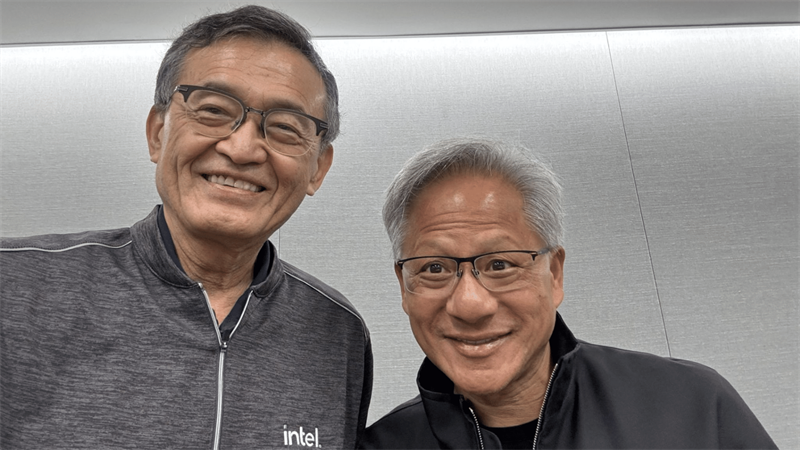

Nvidia CEO Jensen Huang confirmed the deal on September 18, describing it as "an incredible investment" following nearly a year of discussions with Intel CEO Lip-Bu Tan, whom he called a longtime friend. The two companies announced the partnership after Nvidia committed to purchasing Intel's common stock at $23.28 per share, potentially giving it a stake of about 4% or more in the U.S. chipmaker.

Under the agreement, Intel will design Nvidia-customized x86 CPUs for use in Nvidia's AI infrastructure platforms, which currently rely on Arm-based CPUs. Nvidia will integrate these processors into its rack-scale NVLink systems, combining them with GPUs to power advanced AI supercomputers. In parallel, Intel will launch x86 system-on-chips that incorporate Nvidia RTX GPU chiplets to enhance performance in PCs and laptops.

Huang said the collaboration opens a $50 billion addressable market across servers and PCs. "We're going to become a very large customer of Intel CPUs, and we're going to be a large supplier of GPU chiplets into Intel chips," he noted.

The deal highlights the reversal of fortunes in Silicon Valley. While Intel's market value has fallen to $143 billion, down 31.8% over the past five years, Nvidia has surged 1,348% to a market capitalization of over $4.25 trillion, fueled by demand for AI accelerators.

Intel CEO Tan emphasized the strategic value of the partnership: "Intel's leading data center and client computing platforms, combined with our process technology, manufacturing and advanced packaging, will complement Nvidia's AI and accelerated computing leadership to enable new breakthroughs."

The announcement sparked a sharp market reaction. Intel shares jumped 22.77% to $30.57 on September 18, briefly surging nearly 30% intraday, while Nvidia shares closed up 3.49% at $176.24. Rival AMD, however, fell 0.78% after an initial 6% drop.

Nvidia said the deal will not affect its collaboration with Arm, while both companies left the door open for potential foundry partnerships in the future. The agreement will, however, use Intel's advanced packaging technology to integrate CPUs and GPUs more tightly.

The investment comes as Intel continues restructuring under Tan, who took over in March after the board ousted Pat Gelsinger. Intel has raised capital through government backing, SoftBank, and asset sales, while announcing a 15% workforce reduction.

Analysts say Nvidia's entry not only stabilizes Intel financially but also underscores Washington's interest in ensuring the U.S. retains a competitive edge in advanced chipmaking. White House spokesman Kush Desai called the deal "a major milestone for American high-tech manufacturing."

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday