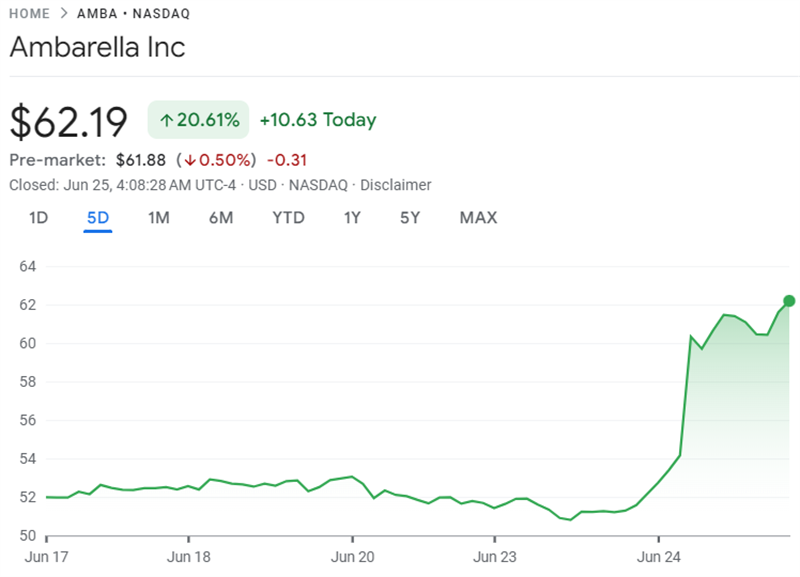

American fabless semiconductor design company Ambarella Inc. (NASDAQ: AMBA) is exploring strategic options, including a potential sale, according to sources familiar with the matter. The Santa Clara-based firm has engaged financial advisors and initiated discussions with potential buyers, prompting its shares to surge 21% to $62.19—its biggest one-day gain since 2021—bringing its market valuation to roughly $2.6 billion.

While deliberations remain ongoing and no deal is guaranteed, industry observers suggest Ambarella's AI-focused portfolio could attract chipmakers seeking to strengthen their automotive or edge AI capabilities. Private equity firms are also said to be monitoring the opportunity.

Ambarella, founded in 2004 and led by co-founder and CEO Fermi Wang, develops low-power, high-performance AI chips used in advanced driver-assistance systems (ADAS), video security, robotics, and more. Its proprietary CVflow® SoCs power computer vision at the edge, enabling real-time image processing in vehicles and surveillance systems.

According to analysts, Ambarella is projected to grow revenue by 28% in fiscal 2025, bouncing back from a 2024 slump. However, it has struggled with profitability, last reporting an annual profit in 2017. Executives remain optimistic, citing strong momentum in edge AI—now contributing 75% of sales—and increasing adoption of its chips in applications like autonomous driving, AIoT, and industrial automation.

Ambarella's latest automotive AI SoC, the CV3 series, is built on a 5nm automotive-grade process, integrating sensor fusion, perception, and control for autonomous driving from L2+ to L4. The company showcased its full-stack autonomous platform at Auto Shanghai 2025.

Despite product innovation, Ambarella faces concentration risk: more than 60% of its revenue comes through Taiwanese distributor WT Microelectronics, according to Bloomberg.

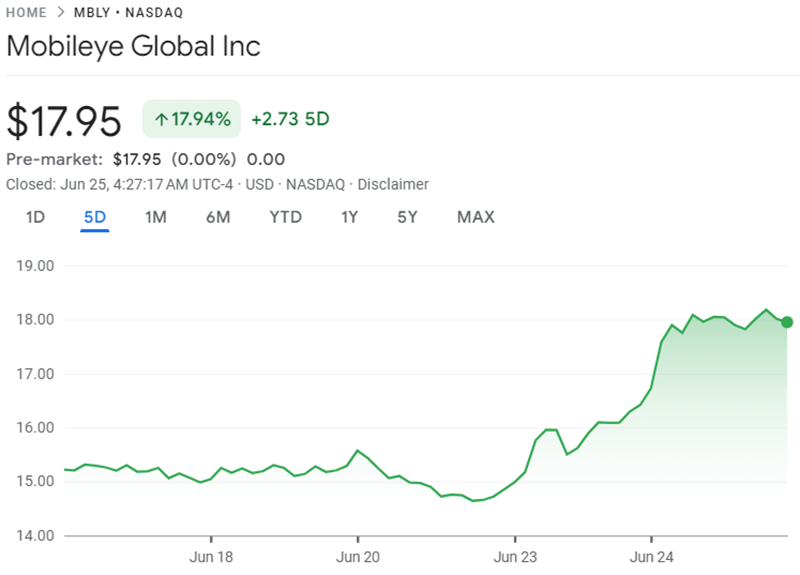

The news of a potential sale also lifted shares of Mobileye, another AI vision chipmaker, by 9.3%. Intel, Mobileye's majority owner, is reportedly weighing options for its stake.

Recent months have seen a resurgence in semiconductor M&A. SoftBank acquired Ampere Computing for $6.5 billion in March, Intel sold a majority stake in Altera to Silver Lake in April, and ON Semiconductor recently dropped a bid for Allegro MicroSystems.

While Ambarella hasn't commented on the reports, its technology leadership in edge AI and video-centric chipsets makes it a strategic asset in a market increasingly shaped by autonomous systems and smart devices.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday