According to South Korea's THE ELEC, Absolics, a subsidiary of SKC, is reportedly close to securing quality certification from AMD for its next-generation glass substrates — a milestone that could mark the company's first major step toward commercialization in the semiconductor packaging market.

People familiar with the matter said that AMD's approval process for Absolics' glass substrates has reached its final stages. The substrate is expected to be used in AMD's advanced semiconductor packaging business.

The potential certification comes as SKC faces pressure to accelerate development in high-value semiconductor materials amid a prolonged downturn in its core chemical and battery foil businesses. SK Group, led by SK hynix, recently held a CEO-level strategy meeting, where executives reportedly reaffirmed the group's long-term commitment to semiconductor growth. SK Group Chairman Chey Tae-won has repeatedly described glass substrates as a potential "game changer" for the chip industry.

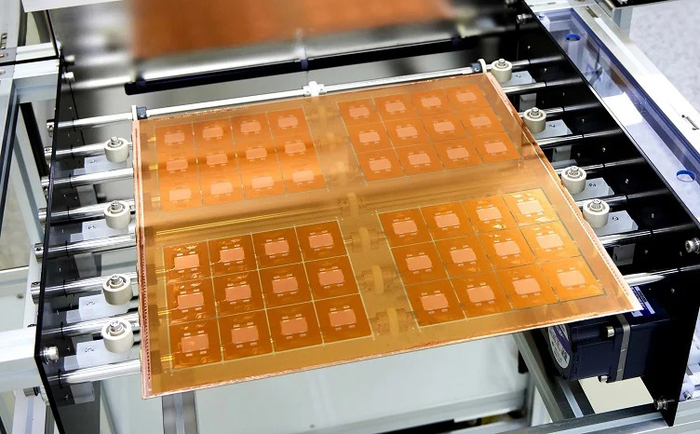

Despite the anticipated certification, industry observers note that Absolics is reconsidering its second-phase expansion plan due to limited initial order volumes. The company completed construction of its first U.S. factory in Covington, Georgia, last year, with an annual production capacity of 12,000 square meters. A planned second-phase expansion — adding 60,000 square meters of capacity — was estimated to require roughly 500 billion won (approximately USD 360 million) over two years.

Sources familiar with SKC's internal discussions say management views such an investment as premature under current demand projections. "Even if AMD approves the glass substrates, the initial volume is expected to be small," one source said, noting that another potential customer, Amazon Web Services (AWS), has indefinitely postponed its quality testing with Absolics.

At the same time, SKC is reviewing plans to relocate its SK Nexilis copper foil production from Jeongeup, South Korea, to Uzbekistan — a move that would require significant capital expenditure and could complicate simultaneous large-scale investment in Absolics.

SKC's latest financials suggest a careful balancing act between new investments and liquidity management. Cash reserves stood at 781.3 billion won as of June and are expected to have increased following a 125 billion won exchangeable bond issuance tied to treasury shares. Meanwhile, proceeds from the planned sale of SK Enpulse's remaining businesses — including the blank mask and CMP slurry units, worth 1.78 billion won combined — are expected to materialize by early 2026.

Absolics, established as a joint venture between SKC and U.S. semiconductor equipment maker Applied Materials, remains a key component of SKC's long-term growth strategy. SKC holds a 70.1% stake in the venture, which is strategically important for the group's shift toward advanced semiconductor materials.

Leadership changes at SKC have also drawn attention to Absolics' management. Former SKC CEO Park Won-cheol, who concurrently served as Absolics' chief executive, was recently succeeded by Kim Jong-woo, who also leads SK Enpulse and SK Signet. Industry watchers suggest that this leadership transition could influence SKC's investment priorities heading into 2026.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday