The United States is undergoing a significant semiconductor resurgence, with Taiwan Semiconductor Manufacturing Company (TSMC), Samsung Electronics, and other major chipmakers pouring unprecedented foreign investment into the country. This surge reflects Washington’s strategy to transform the U.S. from a passive consumer of advanced technology into a proactive manufacturer of critical chips.

Since the Trump administration took office, U.S. chip demand has grown at what analysts describe as an “unprecedented” pace. This demand surge underpins TSMC’s and other foreign chipmakers’ commitments to invest “hundreds of billions of dollars” in the U.S. market in order to build a more resilient, regionally anchored chip supply chain.

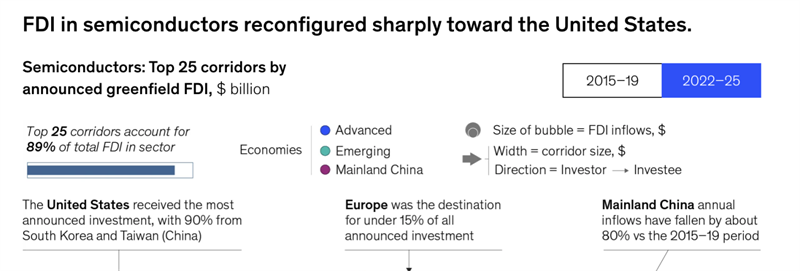

According to a McKinsey projection and industry data, the U.S. semiconductor sector is growing faster than any other region in the world. A chart titled “Semiconductors: Top 25 corridors by announced greenfield FDI, $ billion” also highlights how the U.S. has become the dominant destination for semiconductor FDI between 2022 and 2025.

TSMC Leads the Wave of Advanced Manufacturing in the U.S.

Industry data shows that nearly 90 percent of all global semiconductor FDI in 2025 flowed into the United States, with the majority coming from companies headquartered in Taiwan and South Korea.

Among them, TSMC remains the central force. Its Arizona project—regarded as the cornerstone of America’s advanced chip strategy—is already mass-producing 4-nanometer technology and is preparing to upgrade to the cutting-edge A16 (1.6nm) process. The move underscores TSMC’s long-term commitment to establishing deep manufacturing roots in the U.S. market.

South Korean Investment Surges as Samsung Ramps Up U.S. Capacity

South Korean chipmakers are also accelerating their U.S. expansion. Samsung’s Taylor facility in Texas, which received CHIPS Act funding during the Biden administration, faced delays but has recently returned to schedule, with progress now advancing toward U.S.-based production of its SF2 (2nm) process.

Samsung has also secured high-value orders for Tesla’s custom AI chips, reinforcing its role as a critical pillar of the American semiconductor supply chain. Together with Micron and other manufacturers, South Korean firms have become key players in Washington’s drive to localize fabrication of strategic technologies.

National Security Push Drives U.S. Manufacturing Expansion

One of the strongest catalysts behind the resurgence of U.S. chip manufacturing is the Trump administration’s decision to elevate semiconductors to a national-security priority. President Trump has repeatedly warned that companies such as TSMC could face tariffs of up to 100 percent if they fail to establish viable mass-production capacity on American soil.

Given that a substantial share of TSMC’s customers are U.S.-based, building a stable U.S. production base has become a strategic necessity for the company.

Europe Joins the Westward Shift in Global Supply Chains

The United States is not alone in pushing for semiconductor sovereignty. Europe, after tightening export-control measures and intervening in several high-profile technology transactions, is increasingly moving to safeguard its technological foundations.

TSMC has expanded its footprint in the European Union, notably through its investment in Germany, signaling a broader pivot of high-value chip manufacturing from East Asia toward Western economies.

While these efforts may not deliver full supply-chain independence for the West, they are undeniably strengthening Western manufacturing capacity and competitiveness in advanced semiconductor technologies.

A Global Realignment in Chip Manufacturing

From Washington’s aggressive industrial policies to Europe’s increasingly interventionist approach, the global semiconductor landscape is now undergoing a structural realignment. The common thread is clear: advanced technology manufacturing is shifting westward at a pace not seen in decades.

The rise of large-scale investments from Taiwan and South Korea—led by TSMC and Samsung—marks a historic pivot in the global chip ecosystem, positioning the West as a renewed center of strategic semiconductor production.

+86 191 9627 2716

+86 181 7379 0595

8:30 a.m. to 5:30 p.m., Monday to Friday